Data Security Gude: 8 Steps to Protect Customer PII Data

In fintech, safeguarding sensitive customer data, including Personally Identifiable Information (PII) collected during Know Your Customer (KYC) processes, is a critical priority. KYC is essential for verifying customer identities, preventing fraud, and ensuring compliance with anti-money laundering (AML) regulations. However, securely managing and storing this data poses significant challenges due to its sensitive nature and strict compliance requirements.

Databunker is available in two versions: an open-source edition tailored for solopreneurs or indie founders seeking a fast, compliant solution for customer data storage, and Databunker Pro, designed for businesses, which includes support for enterprise security standards such as multi-tenancy, key rotation, and Shamir’s secret sharing, available for cloud or on-premises deployment.

This guide references the open-source version of Databunker, with the final section covering the features and benefits of Databunker Pro for larger business needs.

This post outlines 8 steps fintech companies can take to strengthen data security, ensure compliance, and build user trust with Databunker.

Step 1: Secure PII/KYC Data Storage and Encryption

Databunker acts as a fortified encrypted vault, enabling fintech startups to securely store sensitive customer data, including PII and financial records. By implementing robust encryption measures, Databunker ensures that data is shielded from unauthorized access and potential data breaches.

All records stored inside Databunker are encrypted.

Here is a sample API request to save a user record:

|

|

Here is a sample API request to save user application data:

|

|

Step 2: Pseudonymization for Enhanced Anonymity and Security

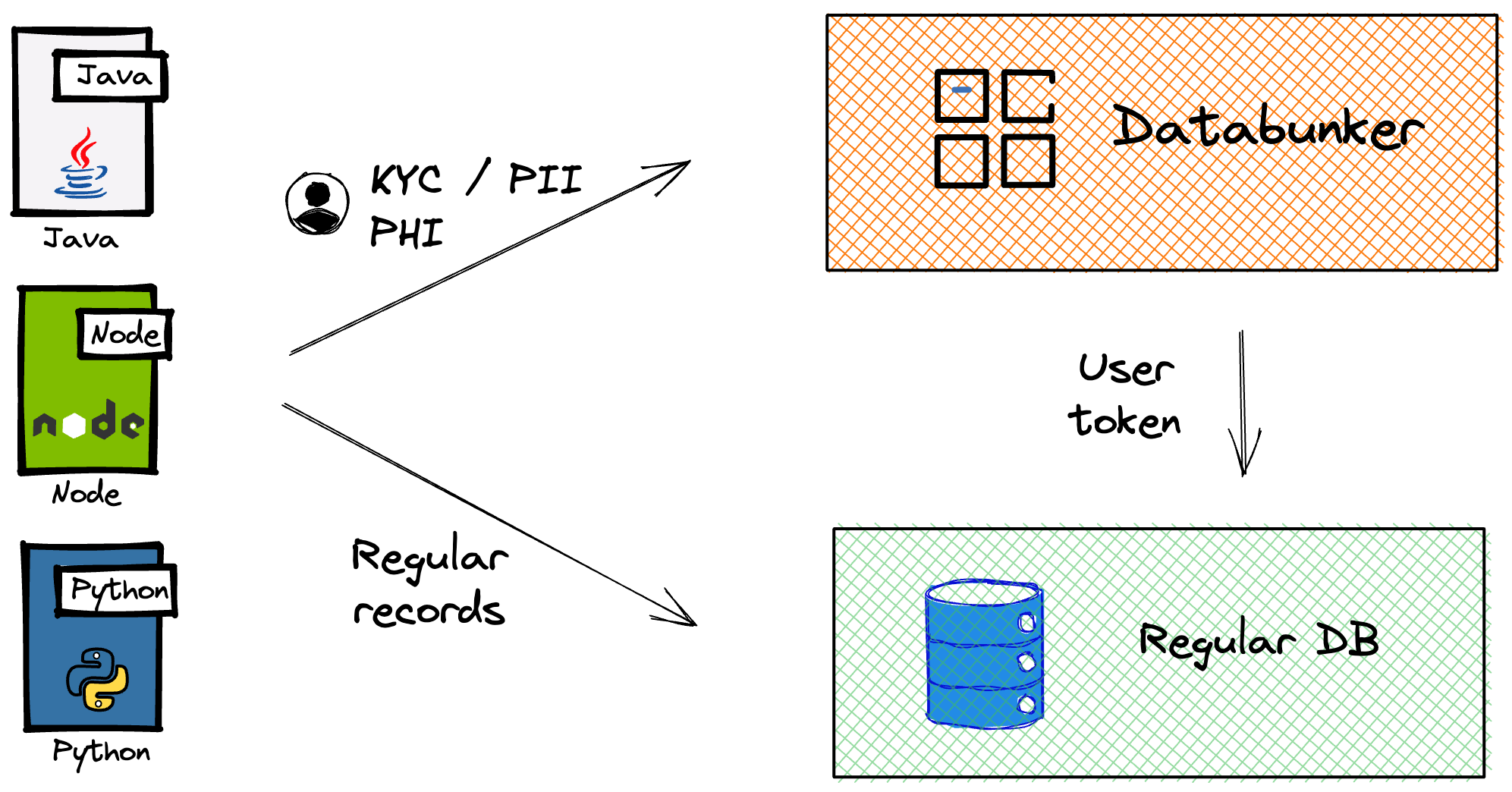

Pseudonymization, a term coined by the GDPR privacy standard, involves storing user details separately from your primary database, creating a pseudonymized identity to reference the original user records. When saving a user record in Databunker, it generates a user token (in UUID format), which you can store in your regular database as a pseudonymized user identifier.

Check out this diagram illustrating this process:

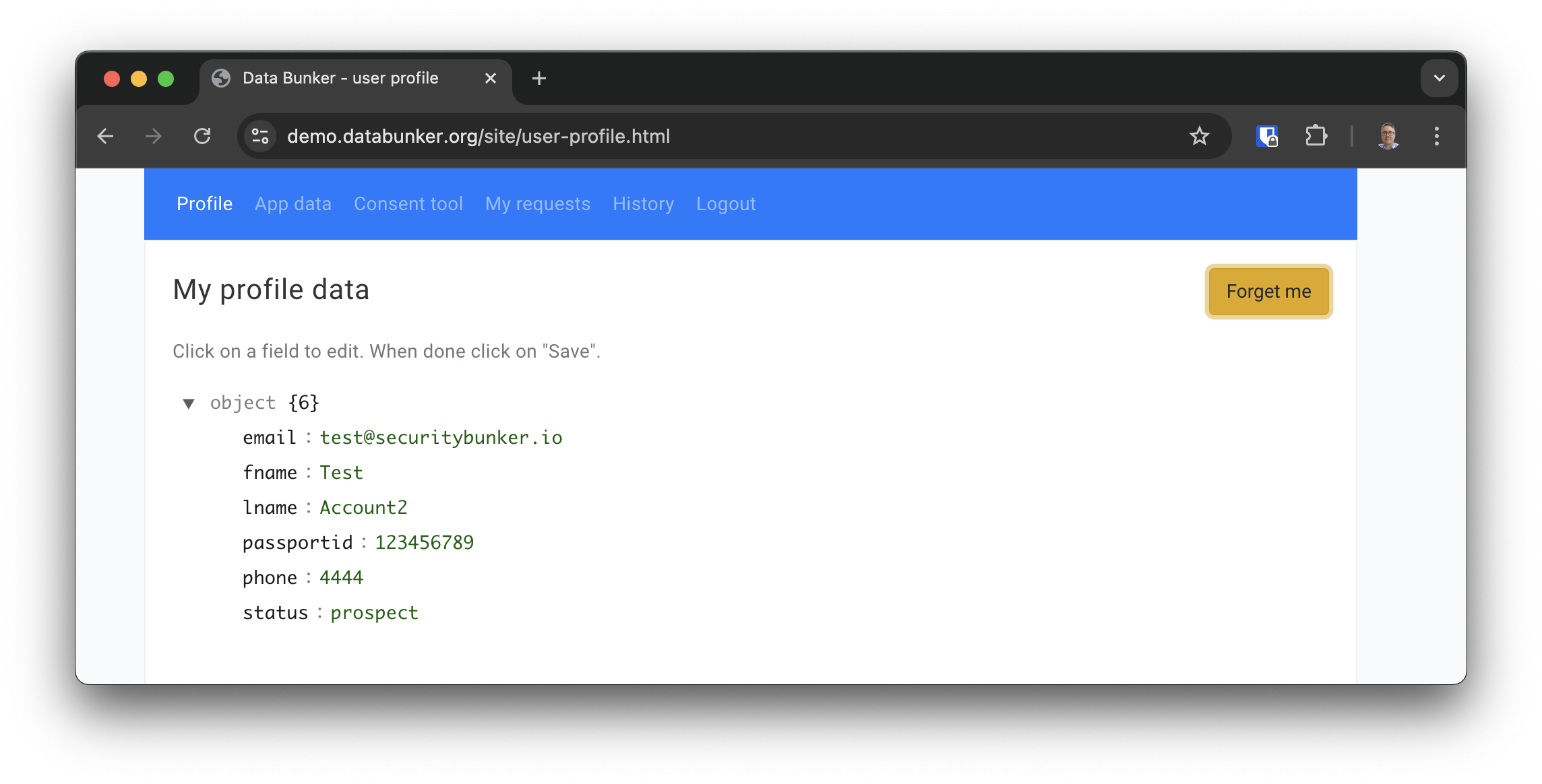

Step 3: User Rights Management

Databunker offers an optional, user-friendly interface that allows customers to access and review their personal data. Admins can choose to enable or disable this feature. When enabled, fintech startups can facilitate data modifications and updates requested by users, ensuring compliance with GDPR’s provisions on individual rights, including the right to access and the right to rectification.

Step 4: Forget-Me Operation

Databunker offers an easy-to-use interface for admins or Data Protection Officers (DPOs) to delete user data when requested. Users can ask to have their data removed through an optional interface, and Databunker manages the entire process, ensuring compliance with GDPR and building trust with customers.

Step 5: Comprehensive Audit Trails and Logging

Databunker automatically generates audit trails and logging features, allowing fintech startups to track and monitor data access and activities. These comprehensive logs enable organizations to maintain compliance with regulations such as SOC2 and provide valuable insights in the event of security incidents.

Step 6: Data Encryption in Transit

To safeguard customer secrets during data transmission, Databunker extends encryption measures to data exchanged between systems. Encrypting data in transit bolsters data integrity and confidentiality, addressing requirements set forth by SOC2 and other relevant frameworks.

Step 7: Privacy by Design Principles

Databunker is designed with privacy by design principles, ensuring that privacy considerations are integrated into the fintech startup’s data handling processes from the outset. This adherence to privacy by design aligns with GDPR’s requirements and strengthens data protection efforts.

Step 8: Use Advanced Security Features

Databunker Pro extends the capabilities of the open-source version with additional features:

- Enterprise security: multi-tenancy, key rotation, and Shamir’s secret sharing

- Advanced Tokenization: Credit card and format-preserving tokenization API

- Available for cloud, on-premises, or embedded deployments

- Advanced access control and data masking

- Professional support

Conclusion:

In today’s fast-evolving fintech landscape, ensuring the protection of customer secrets is a fundamental responsibility for startups. By following these 8 steps and leveraging the power of Databunker, fintech companies can fortify their data security practices, adhere to industry regulations, and build lasting trust with their customers. Safeguarding customer secrets not only strengthens the company’s reputation but also sets the stage for sustainable growth and success in the competitive fintech market.

👋 Want to learn about Databunker?

Take a closer look at how Databunker securely stores and manages sensitive data at scale.